Rogers One Number Service Launched - UC for Consumers

/This was the second day in a row that Ronald Gruia from Frost & Sullivan was with me at an event - that's never happened before, and go figure, we both started working there the same day 11 years ago this week. Time flies, huh? I mention that because during the briefing we saw that the new service is dubbed RON for short. Had to smile, thinking maybe Ron is so influential they named this after him, but I don't think us analysts have quite that much currency. I digress.

So, what is Rogers One Number? Well, aside from the press release, and the Rogers One Number website (where you can sign up now), I'll steer you to my post from almost two months ago, when I got an early heads-up about it. Beyond that, I'll add some takeaways based on yesterday's briefing and demo.

First, the demo was held at their "Connected Condo", which is exactly as it sounds. They've carved out some office space at HQ, and dressed it up as a one bedroom condo to showcase how the perfect Rogers customer would live. So, you name the Rogers service, and this condo has it - TV, Internet, cordless phones, a tablet, a very cute kitchen counter mini-tablet for their Home Monitoring service, etc. We should all be so lucky, huh? My photos below provides a bit of that flavor. Anyhow, it's a great way to demonstrate residential services, and to make it even more realistic, they had an actual One Number user speak about how nicely the service ties together so many apps he uses all day long.

Second - let's get this straight. One Number is free for - and among - Rogers wireless subscribers. Based on what I've seen so far, they need to get that message across more clearly, as the mainstream market may have enough trouble just understanding the concept - and if it seems complicated, my guess is they'll assume it costs money, at which point, you'll lose them. This is a great service for early adopters, and anyone who recognizes the potential to really cut back on their wireless LD and roaming costs when calling other Rogers wireless subscribers. Once you understand what RON is, and that it's free, the value proposition is pretty strong, even for a light mobile user like myself. And, yes, I DID sign on for the service after the demo. If you do the same, let's try it out together!

Third - for now, RON is basically a bridge that makes your PC an extension of your wireless phone - and vice versa. I think of RON as UC for consumers with nice FM/FM and FMC capabilities. In my initial post, I explained what CounterPath brings with the softphone client, which is a key enabler for RON, and if it provides a reliable, high quality experience, this could be a very sticky application. To me, that's a pretty big deal for a few reasons - see below.

Sticky factor #1 - by bringing your mobile contacts into the PC environment, these modes become interchangeable. Think about that - not only is mobile call quality very uneven (and it doesn't matter how much you spend on the service!), but smartphones are pretty stupid when it comes to being used for phone calls. The latter is one of my biggest pushbacks against mobility - these devices are great mini-PCs, but the telephony experience seems like an afterthought. Anyhow, you can save a lot money making these calls on the PC, and that's good news for any mobile subscriber. Even better if you get a better calling experience, which PC-based VoIP can deliver, especially if your alternative is making a mobile call while walking down a busy street (and really, how many people doing that do you think are actually talking to somebody?)

Sticky factor #2 - if you haven't already figured out, RON is a Skype-killer. In my book, whoever owns the contact directory owns the customer, and once you import your mobile contacts, there will be less reason to use Skype - either for voice calls or video calls. This is a pretty good flanking move for Rogers, just in case any of the other IM-based/OTT services - MSN, Yahoo, Google, AIM, etc. - want to ramp up efforts to siphon minutes off the Rogers network.

Sticky factor #3 - I asked about extending RON to tablets or even Apple TV, but neither are in the mix yet. It's too early for those interfaces, but I had to ask, since those are the only screens not supported by RON. At some point I think both will happen, so if you think RON is sticky now, wait until you can use it on those screens.

Sticky factor #4 - don't forget the landline! I don't know what their business case models look like for RON, but you have to figure they'll lose some wireless LD and roaming revenue from subscribers who shift these types of calls to the PC. Fair enough, but Rogers also has quite a few Home Phone subscribers. Now that there's an official CRTC plan to phase out the PSTN in the next couple of years, all landline providers face the same endgame. Rogers, of course, has the least to lose since they don't have a legacy infrastructure, and the landline business is really gravy. Since it's VoIP, they can make some hay by grabbing more PSTN subscribers from the telcos, and with RON, they have an even stronger value proposition to get those wins. Think about how strong that bundle will look compared to what the incumbent might be offering. Coming back to the business model, however, there will also be some lost revenues to consider. If RON really works as advertised, the value proposition for Home Phone will diminish, perhaps to the point where it's simply not needed. Right?

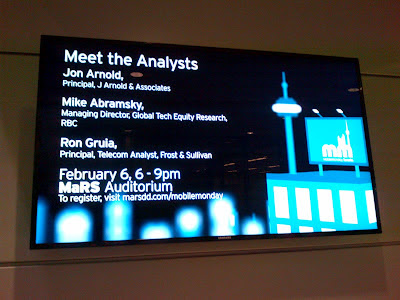

We were told this service is the first of its kind in North America, and I can't counter that - so it must be true! Not only is this good to see coming from a Canadian operator, but from a cableco nonetheless. This is very much in line with the innovation issues we talked about the previous night at MobileMonday, and serves as another example of how changes in telecom are not being driven by the telcos. When successful innovation comes from the outside, the rules change, and they're no longer being made by those on the inside. It's hard to say if One Number is a game-changer, but in my mind, Rogers has the right idea here - now let's just see if the market gets it.